Accenture, a leading global professional services company, incorporated in Dublin, Ireland, has been actively involved in sponsoring sailing events.

According to the search results, Accenture partnered with The Ocean Race and Virtual Regatta to launch a metaverse experience for the world-renowned global yacht race. This collaboration aimed to engage fans and businesses in a new way with the race, allowing gamers and enthusiasts of the race’s official e-sailing game, Virtual Regatta, to take part in exclusive online events, interact with other fans, and get access to team stats. This initiative reflects Accenture’s commitment to innovation and its efforts to enhance fan experiences through technology4.

Accenture, originally known as Andersen Consulting, is a spin-off from Arthur Andersen. This separation occurred prior to the Enron scandal. The split was finalized in 2000 after a protracted dispute between Andersen Consulting and Arthur Andersen, which was primarily over profit-sharing and the direction of the business rather than a direct response to conflicts of interest between auditing and consulting services47. However, the separation did effectively address the conflicts by legally and operationally distinguishing the consulting operations from the auditing and accounting services provided by Arthur Andersen.

Accenture today is a leading global professional services company that offers a wide range of services and solutions in strategy, consulting, digital, technology, and operations. With approximately 743,000 employees serving clients in more than 120 countries, Accenture focuses on helping organizations build their digital core, optimize operations, accelerate revenue growth, and enhance citizen services. The company is deeply involved in technology innovation and maintains strong ecosystem relationships, positioning itself at the forefront of driving change across industries. Accenture’s services span across various domains including Strategy & Consulting, Technology, Operations, Industry X, and Song, aiming to create tangible value at speed and scale for its clients3.

Industry X is a digital transformation service offered by Accenture, combining powerful digital capabilities with deep engineering, manufacturing, and infrastructure expertise. It focuses on helping companies embrace digital technology to drive new levels of efficiencies, customer experiences, and sustainability. This involves embedding Internet of Things (IoT) connectivity, cloud computing, analytics, and machine learning to boost overall productivity, quality, flexibility, and safety for the entire enterprise1.

On the other hand, Accenture Song is a tech-powered creative group within Accenture that focuses on growth through relevance by connecting industry expertise and analytical precision with ambitious, empathetic creativity. It helps organizations find new pathways to growth by discovering customers’ needs to create relevant new products, services, and experiences in a repeatable and scalable way. Accenture Song also helps marketing organizations adapt to the ever-evolving needs of customers and unlock efficiency to accelerate growth through change35.

The decision to rebrand Andersen Consulting to Accenture was made following an arbitration ruling that granted the consulting firm its independence from Arthur Andersen and Andersen Worldwide. The new name, Accenture, which signifies “accent on the future,” was adopted on January 1, 2001, and was part of a strategic move to reflect the firm’s growth strategy and its focus on innovation and the future1. This rebranding occurred before the Enron scandal came to light, and thus, Accenture was not implicated in the scandal and operated independently from Arthur Andersen’s auditing practices. The separation and subsequent rebranding shielded Accenture from the fallout of the Enron scandal, allowing it to maintain and grow its reputation in the consulting and technology services market27.

https://m.youtube.com/watch?v=v7dLuz0OadY&feature=youtu.be

Arthur Andersen

Arthur Andersen, once one of the largest accounting firms, was convicted in 2002 for obstructing justice by shredding documents related to its client Enron Corporation, which was itself embroiled in a massive accounting scandal. However, the conviction was overturned by the Supreme Court in 2005 because the jury instructions were flawed; they did not properly convey the law regarding “corrupt persuasion” under which Arthur Andersen was charged2. Despite the overturned conviction, the damage to Arthur Andersen’s reputation was irreversible, and the firm did not return as a viable business2.

The responsibility for the document shredding at Arthur Andersen was attributed to various levels of the firm’s management. The government charged that the massive shredding of Enron-related documents and the purging of electronic files was launched in October 2001. The indictment alleged that Arthur Andersen continued to shred documents and delete computer files relating to its audit of Enron, even after it was aware that civil litigation and government investigations were imminent and even after Enron had received an SEC subpoena. The shredding was done at the direction of the Houston management team, high-level employees in the Chicago office, and an Andersen lawyer. The destruction of documents was a key factor in the obstruction of justice charges against Arthur Andersen13

Arthur Andersen employees were not explicitly required to understand that document shredding violated the firm’s own policies. The government charged that the massive shredding of Enron-related documents and the purging of electronic files was launched in October 2001. The indictment alleged that Arthur Andersen continued to shred documents and delete computer files relating to its audit of Enron, even after it was aware that civil litigation and government investigations were imminent and even after Enron had received an SEC subpoena. Arthur Andersen defended the charge by claiming that its employees were merely following the firm’s document retention policy. On May 31, 2005, the Supreme Court reversed the conviction because the jury instructions issued by the trial court were inadequate. Although the Supreme Court’s decision focused on the instructions to the jury, the Court recognized that routine document destruction should be permitted in many situations2.

The responsibility for the shredding was also attributed to specific individuals within the firm. For instance, an Andersen attorney, Nancy Temple, sent an email authorizing the shredding, and David Duncan, the lead Enron auditor, was accused of organizing a document destruction effort shortly after learning about the SEC inquiry into Enron’s accounting practices2.

Nancy Temple, second from the left, testifies with other Arthur Andersen witnesses on January 24, 2002.

The consequences for Arthur Andersen employees who violated policy were severe. The firm was convicted by a Texas jury of violating the former 18 U.S.C. §§ 1512(b)(2)(A) and (B) by “knowingly, intentionally and corruptly persuad(ing) other persons, to wit: petitioner’s employees, with intent to cause them to withhold documents from, and alter documents for use in, official proceedings, namely: regulatory and criminal proceedings and investigations.” This conviction helped to ensure the demise of Andersen5. Additionally, in October 2002, Arthur Andersen received the maximum criminal penalties – a $500,000 fine and five years’ probation – for destruction of documents relating to Enron1. The potential consequences for improper destruction of relevant information are wide-ranging and may be severe, including civil sanctions and criminal sanctions, such as fines and imprisonment1. Therefore, the employees who violated the document retention policy faced legal and professional repercussions.

During the Enron case, evidence of Arthur Andersen’s document shredding was found to be factual by the court. The government charged that the massive shredding of Enron-related documents and the purging of electronic files was launched in October 2001. Andersen employees on the Enron engagement team were instructed by Andersen partners and others to destroy immediately tons of paper related to the Enron audit. The shredding was done at the direction of the Houston management team, high-level employees in the Chicago office, and an Andersen lawyer1.The shredding was a substantial undertaking over an extended period of time, and it ceased only after Andersen was served with a subpoena from the SEC3. The destruction of documents was a key factor in the obstruction of justice charges against Arthur Andersen.

Arthur Andersen played a significant role in the Enron scandal as the accounting firm responsible for auditing Enron’s financial statements. During their partnership, Arthur Andersen auditors failed to detect or chose to ignore accounting frauds, which were facilitated by Enron’s complex financial statements and aggressive accounting techniques.

The firm was billing Enron $1 million per week for auditing and consulting services, and there were conflicts of interest due to the lucrative fees and the close relationship between the two companies’ personnel1.

Enron

Enron was an American energy, commodities, and services company based in Houston, Texas. It was founded by Kenneth Lay in 1985 as a merger between Lay’s Houston Natural Gas and InterNorth. Enron employed approximately 20,600 staff and was a major electricity, natural gas, communications, and pulp and paper company4.

The book and film called the Smartest Men In The Room provides a detailed look into the complex web of deceit and corruption that characterized the Enron scandal, offering insights into the consequences of unchecked corporate greed and the failure of regulatory oversight.

Enron was involved in causing unneeded brownouts in California by manipulating the state’s deregulated energy market. They crafted schemes with nicknames like “Death Star” and “Fat Boy” to withhold power and create artificial scarcity, which led to inflated prices and rolling blackouts3. This manipulation contributed to the California electricity crisis and had long-lasting effects on the state’s energy policies.

The Death Star was the Empire’s ultimate weapon: a moon-sized space station with the ability to destroy an entire planet. But the Emperor and Imperial officers like Grand Moff Tarkin underestimated the tenacity of the Rebel Alliance, who refused to bow to this technological terror

Enron’s spin-off of portions of its operations was part of a strategy to remove liabilities from its balance sheet while maintaining management control. Enron used Special Purpose Vehicles (SPVs) to transfer assets and debts off its books, which allowed them to hide losses and inflate their financial position13. Some consequences of these practices included:

- Enron’s collapse, which was the largest corporate bankruptcy at the time, causing significant losses for shareholders and employees1.

- The SEC and other private-sector watchdogs failed to detect and prevent Enron’s fraudulent practices, leading to a crisis in investor confidence4.

- Enron’s use of SPVs was not illegal, but it violated accounting principles and disclosure requirements, leading to conflicts of interest and financial misrepresentation13.

Arthur Andersen, as Enron’s auditor, failed to disclose these wrongful business practices. The conflict of interest created by Arthur Andersen providing both consulting and auditing services to Enron compromised their ability to perform unbiased audits, leading to a lack of professional behavior and competence1. Some examples of the business practices considered wrong that Arthur Andersen failed to disclose include:

- Inadequate disclosure of Enron’s accounting for stock, which led to a conflict of interest through understating liabilities1.

- Failure to detect Enron’s fraudulent consolidations to hide losses and debt from investors1.

After the scandal, Arthur Andersen no longer exists, and Enron ceased to exist as well. While the Enron name remains synonymous with corporate fraud, the Andersen name is not so encumbered.

There are several Andersen Global locations in Africa, including Zambia, Kenya, Tanzania, and Mozambique.

Andersen Worldwide, now known as Andersen Global, is an international association of legally separate, independent member firms that provide services under the brand names Andersen, Andersen Tax, Andersen Tax & Legal, or Andersen Legal. Andersen Global was established under that name in 2013 and has since expanded its global presence significantly. After the collapse of Arthur Andersen and Enron, many employees sought work elsewhere. Some former Arthur Andersen employees regrouped at Andersen Worldwide to eventually form a new firm named Andersen Global5.

Andersen Global

Andersen Global has a presence in over 170 countries as of the latest reports. The organization has been actively expanding its global mobility capabilities, valuation services, and legal services across various regions, including Africa, Europe, the Middle East, and the Caribbean135.

The Latin American member firms of Andersen Global now operate under the brand “Andersen,” reinforcing the organization’s position as a one-stop shop for tax and legal services1.

Andersen Global has been unifying its platform under the Andersen brand in various regions, including Canada and the United Arab Emirates, to enhance its seamless service capabilities and create long-term value for clients13. The member firms of Andersen Global have received numerous recognitions for their tax and legal services, further highlighting the organization’s commitment to providing clients with best-in-class services globally1.

Andersen Global has a presence in numerous cities across Europe, including Spain, Portugal, Germany, Ireland, France, Luxembourg, the United Kingdom, Italy, and more.

In summary, Andersen Global has successfully reconstituted itself from the remains of Arthur Andersen and has established a strong international presence, offering a wide range of professional services under the Andersen brand. The organization, like Accenture, continues to expand and strengthen its global platform, with a focus on providing integrated solutions to its clients.

Texas

Texas, where Enron was incorporated and headquartered, reacted to Enron’s failure with a mix of regulatory and market responses. Enron had been a significant player in lobbying for the deregulation of Texas’s energy market, which was implemented despite the company’s collapse4. The Texas Public Utility Commission fined Enron for market manipulation and eventually barred them from the state’s market4. Several energy companies are incorporated in Texas, including ExxonMobil, ConocoPhillips, Valero Energy, and Marathon Petroleum, among others4.

Enron’s former employees dispersed across various industries, with some finding jobs in other energy companies, financial institutions, or starting their own businesses within Texas.

A sign depicting Reddy Kilowatt, the mascot for Houston Lighting & Power, in the 1970s. Via The University Of North Texas’ Portal To Texas History

Enron’s push for deregulation was part of its broader strategy to capitalize on the opportunities presented by the opening of new, unregulated energy markets. The lobbying efforts were successful, and in 1999, Texas Senate Bill 7 was signed into law, paving the way for the deregulated electricity system that is still in place in Texas today4.

Comstock Resources, a gas drilling company, was mentioned in a Washington Post article as having performed well during the Texas winter storm. The company’s chief financial officer, Roland Burns, made a statement indicating that they were able to get “super premium prices” on natural gas, and that the cold snap was “like hitting the jackpot.” However, it’s important to note that while the company benefited from the surge in natural gas prices during the storm, there is no direct evidence linking Comstock to the freezing deaths of 246 people. The freezing deaths were a result of the severe winter storm that hit Texas in February 2021, causing widespread power outages and water shortages. While the energy deregulation laws have been subject to scrutiny in the context of the Texas power grid failure, attributing liability for the freezing deaths to a specific company like Comstock would require a detailed investigation and legal determination, which is beyond the scope of available information1.

Nonetheless The failure of Comstock to sufficiently winterize electricity and gas systems after the 2011 winter storm was also highlighted as a contributing factor to the 2021 winter blackout in Texas5. Therefore, the consequences of not winterizing energy distribution assets in Texas are widespread power outages, fuel supply issues, and an increased risk of interdependency failures between natural gas and electric reliability.

The consequences of not winterizing energy distribution assets in Texas, as evidenced by the 2021 winter storm, are significant. The lack of winterization led to numerous generation outages, impacting power generation, natural gas production, and transportation infrastructure. This resulted in widespread power outages, fuel supply issues, and an interdependency between natural gas and electric reliability. The 2021 Texas freeze event exposed the inability of the state’s energy supply chain to withstand extreme cold temperatures. The Federal Reserve Bank of Dallas noted that the severe weather and power cut-off impacted natural gas producing, processing, and transporting infrastructure at the same time1.

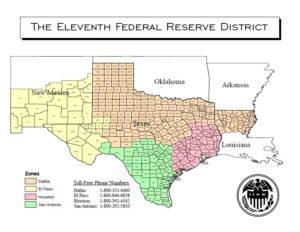

The Federal Reserve Bank of Dallas is one of 12 regional banks that make up the Federal Reserve System

In response to the outages during the 2021 winter storm, Texas passed Senate Bill 3, which requires electric generation providers to winterize both their infrastructure and operations or face fines of up to $1 million a day for each offense. The bill also mandates weather emergency preparedness standards for all power generators selling to the Texas market and requires critical natural gas facilities to adhere to winterization standards determined by the Texas Railroad Commission2. This doesn’t appear enough to satisfy the federal government, which has halted LNG exports from Texas.

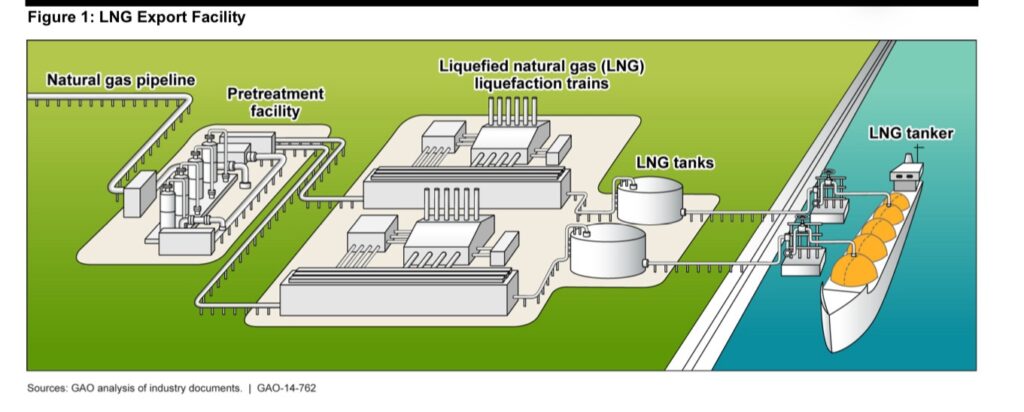

The federal government’s role in regulating LNG exports from Texas involves several agencies. The Department of Energy (DOE) is responsible for evaluating and approving applications to export LNG to countries without existing free trade agreements with the United States. The DOE conducts a public interest review, which includes economic and environmental assessments, before granting export authorizations to non-free trade agreement (non-FTA) countries. The Federal Energy Regulatory Commission (FERC) is responsible for authorizing the siting, construction, and operation of LNG export facilities in the U.S. FERC’s review process is considered a federal action and is subject to the National Environmental Policy Act (NEPA). The DOE’s export approvals, as of late August 2014, amounted to 10.56 billion cubic feet of natural gas per day in the form of LNG12.

Today, the United States is the world’s largest producer of natural gas. Natural gas supplies about 1/3 of the United States’ primary energy consumption, with its primary uses being heating and generating electricity.

The public interest determination underpinning the Biden administration’s decision to pause new natural gas export approvals from Texas while it evaluates the impacts of LNG exports on energy costs, America’s energy security, and climate is a complex and multifaceted issue. The pause on new LNG approvals is intended to allow for a comprehensive evaluation of the impacts of LNG exports on energy costs, America’s energy security, and the environment, including climate change considerations3. The decision responds to environmental and climate justice activists advocating against the LNG terminals that Those activists, from communities in Louisiana and Texas already contending with climate-fueled hurricanes and fossil fuel and petrochemical made their presence felt at monthly meetings of US energy regulators in Washington3. Therefore, the public interest determination underpinning the pause on new LNG approvals is based on a wide range of factors, including energy costs, energy security, environmental impacts, and climate considerations. The decision reflects a comprehensive approach to evaluating the public interest associated with LNG exports.

Arthur Andersen, as it was known, no longer exists due to the irreversible damage to its reputation following the scandal. A group of former partners later reconstituted a firm under the name Andersen Global. Enron also ceased to exist, having gone bankrupt due to the scandal. The Enron name remains synonymous with corporate fraud and corruption, influencing stricter regulations and oversight in the financial and energy sectors1.

As mentioned, Texas implemented the deregulation of energy markets that Enron had lobbied for in spite of the Enron scandal.

The Sarbanes-Oxley Act (SOX) was enacted in response to the Enron scandal. The act was passed in 2002 as a reaction to a number of major corporate and accounting scandals, including those affecting Enron and WorldCom. The Enron scandal, in particular, played a significant role in the creation of SOX, as it exposed serious deficiencies in corporate governance, financial reporting, and regulatory oversight. The act aimed to prevent future accounting scandals by enhancing the accuracy and reliability of corporate disclosures in financial statements and other documents, improving internal financial controls, and increasing the oversight role of boards of directors and the independence of external auditors34. Therefore, the Enron scandal was a key factor that led to the passage of the Sarbanes-Oxley Act.

The Sarbanes-Oxley Act (SOX) addresses key behaviors and practices to prevent corporate fraud and improve financial reporting. Some of the key behaviors and practices addressed by SOX include:

- Internal Controls: SOX requires organizations to implement internal controls to ensure accurate financial reporting. These controls help prevent and detect errors, safeguard activities within the financial reporting cycle, and make it difficult for companies to conceal fraud and misconduct2.

- Segregation of Duties (SoD): SOX mandates the segregation of duties, which involves dividing duties among multiple people to reduce the likelihood of errors or improper conduct. For example, someone who prepares financial statements should not also be responsible for recording transactions2.

- Authorizations and Approvals: SOX requires that all authorized transactions be approved by a person with the appropriate level of authority, confirming that the transaction is consistent with policies2.

- Reviews and Reconciliations: Organizations must regularly review and reconcile financial records to confirm that transactions have been processed correctly2.

- Safeguarding of Assets: SOX mandates the physical security of equipment, inventories, cash, and other property, as well as periodic counts and comparisons with control records2.

- Training and Supervision: Employees need knowledge to do their jobs well, direction and supervision to know what is expected of them, and channels for reporting any wrongdoing2.

SOX also requires CEOs and CFOs to certify the accuracy of the company’s financial statements, prohibits insider trading, restricts loans to executives, and prohibits public companies from retaliating against whistleblowing employees2. Overall, SOX aims to create a more transparent and accountable corporate environment, making it more difficult for fraud to occur.

The Act also requires public companies to adopt internal procedures for ensuring the accuracy of financial statements and makes the CEO and CFO personally responsible for the accuracy, documentation, and submission of the financial reports and internal control structure2.

This requirement is outlined in Section 302 of SOX, which directs the SEC to adopt rules requiring the principal executive and financial officers of a public company to certify the accuracy and completeness of the annual and quarterly reports, and the adequacy of internal controls with regard to such disclosure24. The purpose behind SOX 302 is to ensure that the CEO and CFO are proactive with respect to their company’s public disclosure, with a goal toward improving investor confidence3.As for board members, they are not required to provide personal certifications of financial statements under SOX. The personal liability of officers, including CEOs and CFOs, for the accuracy of financial statements is a key feature of SOX. In the event of bankruptcy, shareholders may seek remuneration from the personal wealth of officers if it is determined that they knowingly or willfully submitted non-complying financial statements43.

The Enron scandal also resulted in the Sarbanes-Ox-ley Act of 2002, which created the Public Company Accounting Oversight Board. The law also restricts auditing companies from providing consulting services to the same client, limiting conflicts of interest….

Strict enforcement around accounting firms and their consulting practices came in the wake of the Enron scandal. Accounting firm Arthur Andersen, then one of the “Big Five” accounting firms, mishandled audits of Enron and was convicted of obstruction of justice, but the conviction was later overturned. The firm dissolved and sold its businesses off to competitors, including what is now called the “Big Four,” comprised of Deloitte, KPMG, PwC and EY.

Amy Banovich now serves as KPMG’s Seattle office managing partner. She joined the firm after the Enron scandal and implosion of Arthur Andersen, where she had worked for seven years.

A Technical Balancing Act, Puget Sound Business Journal, February 16-22 2024

The Enron scandal was a series of events that led to the bankruptcy of the U.S. energy, commodities, and services company Enron Corporation in 2001 and the dissolution of Arthur Anderseny LLP, one of the largest auditing and accounting companies in the world. The scandal had far-reaching repercussions, particularly for recent graduates who had joined Arthur Andersen prior to the debacle.

In our story, a group of bright and eager graduates felt they had hit the jackpot when they were selected to join Arthur Andersen, one of the prestigious Big 5 accounting firms. They were excited about the opportunities that lay ahead and the chance to work with some of the best minds in the industry. However, as they settled into their roles, they soon realized that being a “good fellow” at the firm meant keeping certain information behind closed doors.

They were expected to report suspected wrongdoing by clients only to Arthur Andersen partners, who unfortunately did nothing with this information. As the Enron scandal unfolded, it became clear that the firm had turned a blind eye to the questionable practices of its clients. The once noteworthy resume item of joining a Big 5 accounting firm became something to leave off resumes as they sought work outside of Arthur Andersen.

The lesson learned was that when it comes to wrongdoing, following company policy and being a good fellow can ruin careers as well as companies. The graduates realized that ethical conduct and transparency are essential, and turning a blind eye to misconduct can have severe consequences. The Enron-Andersen debacle led to significant changes in the accounting industry, highlighting the importance of due diligence and ethical behavior in corporate governance and financial reporting.

The story of these graduates serves as a cautionary tale, emphasizing the importance of upholding ethical standards and speaking out against wrongdoing, even if it means challenging the status quo within a company. The Enron scandal and its aftermath underscored the need for robust regulatory oversight and ethical leadership in corporate America.

The Enron scandal and its aftermath underscored the need for robust regulatory oversight and ethical leadership in corporate America. The graduates’ experience serves as a reminder that upholding ethical standards and speaking out against wrongdoing are essential, even if it means challenging the status quo within a company.

3 thoughts on “Sailing Anarchy – virtual accent on the future”