Catalina Yachts: A Comprehensive History and Analysis

Catalina Yachts was a pioneering American sailboat manufacturer founded by Frank Willis Butler in 1969 in North Hollywood, California, and ultimately declared bankruptcy in January 2026 after 56 years of continuous production. The company became the largest builder of fiberglass production sailboats in the United States, manufacturing over 80,000 vessels throughout its operational history.thestreet+1

Founder and Company Origins

Frank Butler (January 17, 1928 – November 15, 2020) began his boatbuilding journey in 1962 when he contracted with a Southern California builder for a 21-foot Victory Sloop. When that builder ran out of funds and defaulted on a loan from Butler, he received the tooling and completed the boat himself. He then established Wesco Marine in 1961, later renamed Coronado Yachts, before founding Catalina Yachts in 1969. By 1975, Catalina had already produced Catalina 22 hull number 5,000, far exceeding Butler’s original goal of 100 boats and establishing the company as a volume builder of affordable family sailboats.[catalinayachts] Frank personally designed many early Catalina models — including the highly successful Catalina 22 and Catalina 25. He was hands-on in hull, interior and deck design, particularly in the 1970s. Butler’s career trajectory exemplified American entrepreneurial innovation—from machinist and tool shop owner to one of sailing’s most influential figures. He was inducted into the National Sailing Hall of Fame in 2013, a recognition reflecting his impact in democratizing recreational sailing.48north+1

Butler’s critical contribution to Catalina’s enduring success was not primarily technical innovation but rather customer-centric business philosophy. He personally handled warranty complaints and was known to call customers directly to address concerns—a practice that fostered exceptional brand loyalty and repeat business. Frank believed in building “good boats that are a good value for our customers,” a philosophy that shaped every operational decision.wikipedia

Production Methods and Roger MacGregor’s Assessment

Roger MacGregor, founder of the competing MacGregor Yachts, visited Frank Butler’s Los Angeles facility to observe Catalina’s production techniques. MacGregor noted that Catalina employed a traditional approach where skilled craftspeople handled all sections of boat construction from start to finish. In contrast, MacGregor pioneered assembly-line workstations patterned after Henry Ford’s production methodology—each station equipped with specific tools, jigs, fixtures, and parts to perform discrete assembly tasks. This approach dramatically reduced required skill levels and labor costs.practical-sailor

While MacGregor respected Butler as an “excellent boatbuilder,” he concluded that his own workstation methodology was superior for cost management and efficiency. MacGregor noted that competing with family-owned businesses like Catalina was challenging because “their money, egos, and pride are on the line.” Nevertheless, the criticism was not about manufacturing defects or quality compromises; rather, it reflected differing production philosophies suited to distinct market positioning—Catalina emphasized solid construction and value, while MacGregor prioritized accessibility through cost reduction.practical-sailor

Manufacturing Locations

Catalina’s production footprint expanded strategically across multiple decades and geographies:

- North Hollywood, CA (July 1969): Original facility where the Catalina 22 was first builtpacificyachting

- Woodland Hills, CA (1980s forward): West Coast primary production facility housing modern manufacturing equipmentpacificyachting

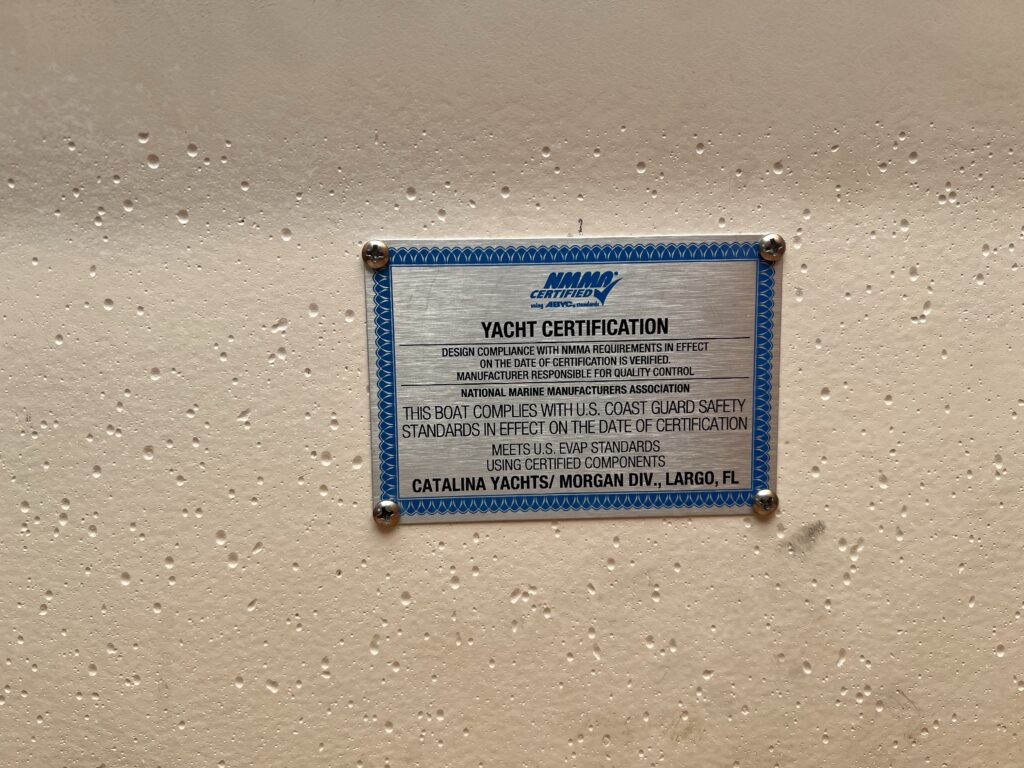

- Largo, Florida (May 1984): Acquired with Morgan Yachts, becoming the East Coast manufacturing hub and eventually the company’s primary headquarterspacificyachting

- International licensing (by 1980): Catalina 22s were built under license in Canada, England, and Australia to meet international demandpacificyachting

By 2025, before its acquisition, Catalina employed over 700 people across these facilities, with approximately 100 hectares and 25,000+ square meters of manufacturing space in Largo alone.cruisingworld

Key Innovations and Design Leadership

Catalina introduced several manufacturing and design innovations that advanced the entire industry:

One-Piece Fiberglass Interior (1964) was the company’s seminal innovation, introduced with the Coronado 25 (precursor to Catalina’s later designs). This technique molded the entire interior as a single fiberglass component bonded to the hull, making boats stronger, lighter, and less expensive to produce than traditional construction methods. This approach became standard throughout the fiberglass boatbuilding industry.reddit+1

Structural Fiberglass Grid System: Catalina’s larger cruisers incorporated molded fiberglass grid structures bonded directly to the hull interior, providing both structural rigidity and a foundation for mounting equipment, engines, and tanks. This innovation enhanced safety and durability in offshore-capable vessels.proboat

Congressional Cup Match-Racing Fleet (1990): Frank Butler designed, built, and donated eleven Catalina 37s specifically engineered for match-racing competition to the Long Beach Yacht Club in 1990. These boats were used exclusively in every Congressional Cup from 1990 forward, validating Butler’s design expertise in performance sailing.ybw

Efficient Design-for-Manufacturing Philosophy: Unlike competitors, Catalina designed hulls and deck layouts with manufacturing efficiency in mind, reducing labor requirements without compromising structural integrity. The company incorporated proven features with incremental improvements rather than radical redesigns, ensuring production consistency and good resale value.wikipedia

Model Chronology and Production History

Catalina’s model lineup evolved systematically, reflecting changing market demands and design refinement:

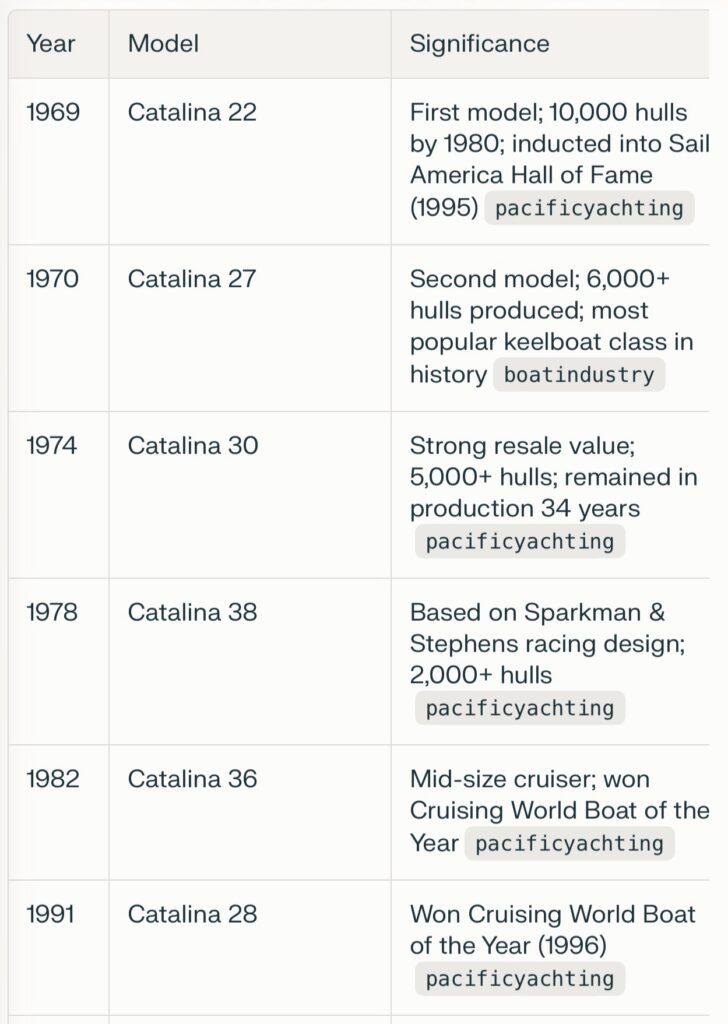

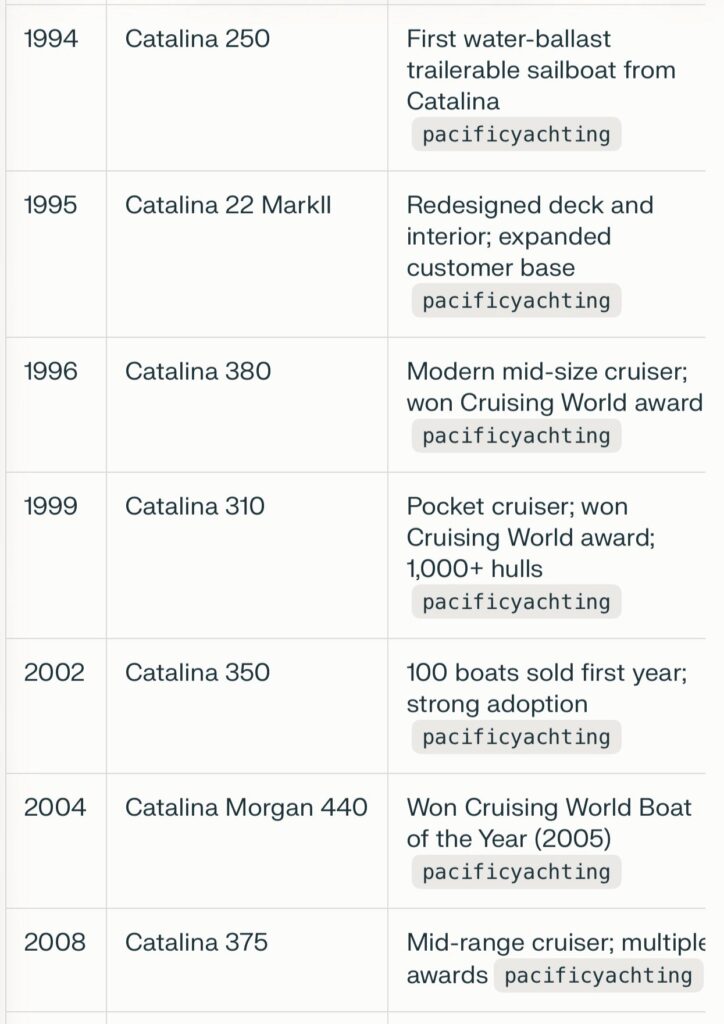

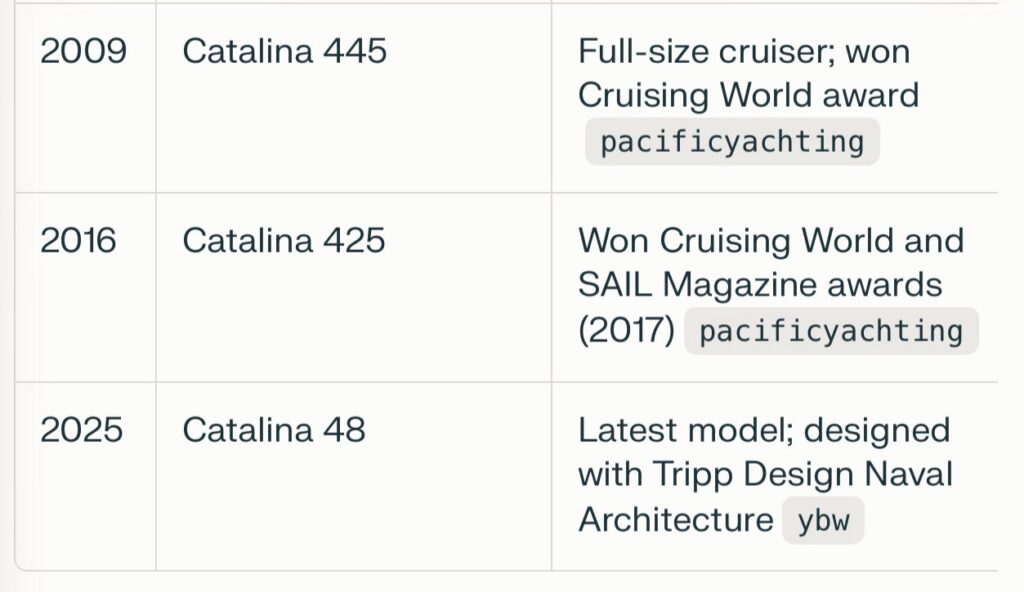

YearModelSignificance1969Catalina 22First model; 10,000 hulls by 1980; inducted into Sail America Hall of Fame (1995)pacificyachting1970Catalina 27Second model; 6,000+ hulls produced; most popular keelboat class in historyboatindustry1974Catalina 30Strong resale value; 5,000+ hulls; remained in production 34 yearspacificyachting1978Catalina 38Based on Sparkman & Stephens racing design; 2,000+ hullspacificyachting1982Catalina 36Mid-size cruiser; won Cruising World Boat of the Yearpacificyachting1991Catalina 28Won Cruising World Boat of the Year (1996)pacificyachting1994Catalina 250First water-ballast trailerable sailboat from Catalinapacificyachting1995Catalina 22 MarkIIRedesigned deck and interior; expanded customer basepacificyachting1996Catalina 380Modern mid-size cruiser; won Cruising World awardpacificyachting1999Catalina 310Pocket cruiser; won Cruising World award; 1,000+ hullspacificyachting2002Catalina 350100 boats sold first year; strong adoptionpacificyachting2004Catalina Morgan 440Won Cruising World Boat of the Year (2005)pacificyachting2008Catalina 375Mid-range cruiser; multiple awardspacificyachting2009Catalina 445Full-size cruiser; won Cruising World awardpacificyachting2016Catalina 425Won Cruising World and SAIL Magazine awards (2017)pacificyachting2025Catalina 48Latest model; designed with Tripp Design Naval Architectureybw

The company also acquired Morgan Yachts in 1984, producing the Morgan 38, Morgan 440, and other models under both Catalina and Morgan nameplates to serve different market segments.pacificyachting

Catalina Yachts has a long, well‑documented arc from affordable trailer‑sailers to larger cruising yachts and, eventually, to the troubled sale in 2025.catalinayachts+1

Founding and early growth (1960s–1970s)

- Frank Butler entered boatbuilding in the early 1960s after taking over production from a builder who could not repay him, first under Wesco Marine and then Coronado Yachts.[en.wikipedia]

- Catalina Yachts as a brand began in 1969 with the Catalina 22 built in North Hollywood; the success of the 22 led quickly to the Catalina 27 (1970) and Catalina 30 (1974), which became one of the most prolific 30‑footers ever built.catalinayachts+1

- By 1975, Catalina had already produced Catalina 22 hull number 5,000, far exceeding Butler’s original goal of 100 boats and establishing the company as a volume builder of affordable family sailboats.[catalinayachts]

Expansion of the line and East Coast manufacturing (1980s)

- The first Catalina 36 launched in 1982, marking Catalina’s push into larger cruising designs aimed at serious coastal and limited offshore cruising.[catalinayachts]

- In 1984, Catalina acquired Morgan Yachts in Largo, Florida; this plant became the Morgan Division of Catalina and allowed large‑boat and charter production on the East Coast, including various Morgan‑branded cruising models.catalina22+1

- The first Catalina 42 was built in 1989, and about 100 hulls were delivered in the first year, breaking U.S. production records for a boat of that size.[catalinayachts]

Record production and awards (late 1980s–1990s)

- Through the late 1980s and early 1990s, Catalina 27 and 30 production each exceeded 6,000 hulls, setting keelboat production records and cementing Catalina as one of the largest sailboat builders in the world (ultimately over 80,000 boats built).wikipedia+1

- The company introduced a string of new models (Catalina 28, 270, 320, 250, etc.) and repeatedly won “Boat of the Year”‑type awards from Cruising World and Sail for boats like the Catalina 270, 320, 380, 310, and later models.[catalinayachts]

- In 1995, Frank Butler received Sail magazine’s Industry Award for Leadership, recognizing Catalina’s role in making straightforward, value‑oriented sailboats accessible to a broad middle‑class market.[catalinayachts]

Morgan integration and larger cruisers (1990s–2000s)

- The Morgan Division in Largo produced larger cruising and charter yachts, including the Morgan 38 and later the Catalina‑Morgan 440 deck‑salon cruiser, which won Cruising World’s “Best Production Cruiser 40–45 ft” in 2005.[catalinayachts]

- Catalina expanded the product line upward with models like the 380, 400, 470, and eventually the 445, targeting more blue‑water‑capable and comfort‑oriented cruisers while maintaining its value positioning.masseyyacht+1

- By 2007, Catalina 42 hull number 1,000 had been built, and the Largo plant had undergone significant expansion (three new buildings adding roughly 56,000 square feet in 2005) to support larger‑boat demand.[catalinayachts]

The 5 Series and modern era (2009 onward)

Gerry Douglas designed Catalina Yachts’ 5 Series sailboats. As the company’s longtime vice president, chief engineer, and primary yacht designer, he created the entire line starting with the Catalina 445, which launched the series.[boats]

Design Leadership Role

Douglas started the 5 Series with a “clean sheet of paper” approach, aiming to elevate performance, construction quality, and sophistication above Catalina’s traditional lineup. He incorporated advanced features like five-part construction (separate hull, grid, liners, and deck), watertight collision bulkheads, and the DeepDefense™ rudder system for enhanced safety and durability.

Key 5 Series Models

His designs included multiple award-winners across four decades:

- Catalina 445 (2009): First 5 Series model; Cruising World Boat of the Year[boats]

- Catalina 425 (2016): SAIL Magazine and Cruising World award winner[sailmagazine]

- Catalina 385, 355, 315: Core series models emphasizing strength and value retention[greatlakesscuttlebutt]

- Catalina 545 (2020): Flagship bluewater cruiser; Cruising World Boat of the Year[cruisingworld]

Career Legacy

Over 45 years with Catalina (1976–2021), Douglas designed 40+ models, with 60,000+ boats built. His work earned 13+ Boat of the Year awards. He became a partner with Frank Butler and emphasized real-world durability alongside market-leading value.[latitude38]

- In 2009, Catalina launched the 445 (as a 2010 model), which became the lead boat in a new “5 Series” of updated cruisers emphasizing ergonomics, systems access, and contemporary interiors; this series later included the 355, 385, and 315.masseyyacht+1

- The Catalina 445 and later the 425 (introduced 2016) both won major magazine awards (Cruising World “Boat of the Year” and Sail “Best Boat”), signaling that Catalina could compete not just on price but also on design sophistication.[catalinayachts]

- Catalina celebrated its 40th anniversary in 2009 and continued to refine and rationalize the line around modern cruising priorities while still supporting a vast legacy fleet and owner community.facebook+1

His departure followed Frank Butler’s death in November 2020, leaving leadership to sales director Sharon Day and production manager Patrick Turner. He likely had expected promotion to president. This transition preceded the company’s 2025 acquisition and 2026 bankruptcy by several years, with Douglas unaffiliated during those events. We can conclude that his leadership was necessary for Catalina to remain an ongoing business.

Ownership transition and sale to Daedalus (2020s)

After Founder Frank Butler died in 2020, and Douglas, the vice president, withdrew his services to the company, the privately held company continued under sales, production, and family leadership.facebook+1

Catalina acquired and integrated the True North powerboat brand, marketing it as “True North by Catalina” and building those boats in Largo alongside larger Catalinas.truenorth+1

In 2025, the Butler family and partners sold Catalina and True North to entities controlled by Michael Reardon/Daedalus Yachts, Reardon paid $1 million plus agreeing to cover approximately $1.425 million in payables. The deal included a lease of the Largo plant; within months, financial defaults, production halts, and litigation led to the effective collapse of that arrangement and the shutdown of Catalina’s long‑running operations at Largo.albemarleobserver+2

the Largo plant was not part of the sale

• The April–May 2025 deal in which Michael Reardon acquired Catalina’s assets included a lease of the Largo, Florida manufacturing plant, not an outright purchase of the real estate.

• California Catalina (the legacy Butler-owned company) remained the landlord; Florida Catalina (Reardon’s entity) was the tenant under that lease as part of the asset purchase agreement.

• When Reardon stopped paying rent after the first month, he defaulted on both the lease and the asset purchase agreement, which triggered acceleration of the deferred purchase price.

Value Retention and Resale Market Performance

Catalina boats have historically demonstrated superior value retention compared to many competitors:

Catalina 30: Remains highly sought on the used market, with typical pricing of $15,000–$35,000 depending on condition and year. Its broad production run (1974–2008) and strong reputation for durability ensure consistent demand from charter operators, sailing schools, and private owners.wavetrain

Catalina 27: With over 6,600 hulls produced over two decades, the C-27 established the most popular keelboat class globally. Demand remains strong among first-time cruiser buyers and experienced sailors downsizing. Used market prices stabilize around $7,000–$15,000 for boats in average condition, with minimal depreciation for well-maintained examples.boatindustry

Catalina 22: While highly numerous (15,000+ produced), the C-22’s value depends heavily on condition and customization. Used examples typically sell for $2,600–$6,000, representing significant depreciation from original ~$25,000 purchase prices. However, used market abundance means buyers can be selective and often negotiate 25–50% below asking prices.sailboatowners

Larger Models (34+): The Catalina 34 and larger models show declining value retention compared to smaller classics. Market data indicates newer models (post-2000) depreciate more rapidly than 1970s–1980s designs, a phenomenon attributed to higher original cost basis and competition from European builders offering comparable features.finance.yahoo

Regional Variation: Catalina boats in Florida typically sell for 10–20% less than equivalent models in the Great Lakes region. A 2004 Catalina 310 that commands $10,000–$11,000 in the Great Lakes might sell for $6,400–$6,600 in Florida, reflecting regional demand elasticity and mooring cost differentials.finance.yahoo

Overall, Catalina boats hold superior resale value compared to most production sailboat competitors due to brand recognition, large owner networks, parts availability, and conservative design philosophy that avoids rapid obsolescence.

Bankruptcy and Recent History (2025–2026)

April 2025: Michael Reardon, founder of Daedalus Yachts, acquired Catalina Yachts and sister company True North Yachts for nominal consideration. True North is a line of Downeast‑style powerboats (e.g., True North 34, 34 Outboard Express, 38) with a traditional workboat aesthetic and resin‑infused fiberglass construction aimed at cruisers who like classic lines but modern performance. Reardon also acquired Tartan Yachts, Freedom Yachts, and other brands with the stated strategy of achieving economies of scale through consolidated management while maintaining brand identities.latitude38 In January 2026, Tartan Yachts — which Reardon had acquired in late 2025 — was sold to a new ownership group led by longtime industry partner Jon Duer after Reardon’s brief stewardship. Something like that may happen with Catalina Yachts.

October 2025: Catalina announced a production pause citing “short-term financial challenges.” Production president Patrick Turner characterized the halt as a “responsible reset” rather than permanent closure.macgregorsailors

October 23, 2025: Reardon was evicted from the Largo manufacturing facility for non-payment of rent. Court documents revealed Reardon had failed to honor contractual rent obligations ($20,000 monthly) and owed $1 million in deferred purchase payments. Employees reported missed payroll and cancelled health insurance benefits.bwsailing

January 6, 2026: Catalina Yachts declared bankruptcy after 56 years of operation. The company was unable to fulfill pending orders or meet financial obligations. Refund claims and warranty matters would proceed through bankruptcy court proceedings.facebook

The precipitous collapse reflected Reardon’s overextension—acquiring multiple struggling brands with minimal capital and attempting to integrate philosophically incompatible business models (mass-market classic sailboat production versus high-tech carbon-fiber catamaran manufacturing). Reardon was connected with Gunboat during a troubled period in its history leading up to and through a previous bankruptcy and subsequent acquisition by foreign interests. This involvement was frequently cited in discussions about his credibility as a turnaround operator — though Gunboat itself was not directly part of the 2025 corporate collapse. Investigations report that despite operating for years and receiving around 1 million dollars in North Carolina state grants, Daedalus apparently never sold a completed Catamaran. When Catalina and the broader “Reardon fleet” imploded publicly in mid‑ to late‑2025, Daedalus’ own facility was on the market, and employees had been laid off.

Beneteau Acquisition Attempts

No evidence exists that Beneteau (Groupe Beneteau), the French marine conglomerate, ever attempted to acquire Catalina Yachts. Beneteau remained a strategic competitor. While Groupe Beneteau owns brands including Beneteau, Jeanneau, and Lagoon catamarans, its American sailboat presence focused on competing pricing strategies rather than M&A activity targeting Catalina. A 2019 article by Massey Yacht Sales noted that Beneteau Group’s brands positioned themselves as price leaders during the recession, while Catalina deliberately moved upmarket by upgrading the product line and creating the “5 Series” of yachts—a different strategic direction entirely.darglow

Frank Butler’s Significance to Catalina’s Success

Frank Butler’s importance to Catalina Yachts cannot be overstated. He was:

The visionary founder who recognized the market opportunity for affordable, practical sailboats accessible to middle-class families and beginner sailors. His stated goal was never to become the largest builder but rather to “build good boats that are a good value.”wikipedia

The operational leader who maintained relentless focus on customer service, quality control, and efficient manufacturing. His hands-on approach to warranty issues and customer feedback created a culture of accountability that persisted through the company’s growth.wikipedia

The design authority who pioneered the one-piece fiberglass interior and directed the company’s design philosophy toward conservative, timeless aesthetics rather than trendy styling. This approach ensured minimal obsolescence and good long-term value retention.wikipedia

The industry advocate who supported major sailing competitions (Congressional Cup), earned SAIL Magazine’s Industry Award for Leadership (1995), and served as a mentor to industry peers.ybw

After Butler’s death on November 15, 2020, at age 92, Catalina continued operating under new ownership but struggled with succession challenges and changing market conditions. By 2025, five years after his passing, the company’s organizational resilience had eroded, culminating in the acquisition by Reardon and subsequent bankruptcy.sailingscuttlebutt

Catalina’s bankruptcy was the cumulative result of several interacting forces, but the decisive damage came from ownership and financial decisions in the last few years, not from any single product-line choice.boatindustry+2

Strategic product choices vs. Beneteau

The move upmarket with the 5 Series and the decision to emphasize larger cruisers and powerboats (e.g., True North) did make Catalina more vulnerable, but it is hard to argue that a continued fight in the low‑margin entry‑level space would have been a safer path. Beneteau and Jeanneau were already dominating that segment globally, leveraging larger volumes, a broader dealer network, and aggressive pricing. Catalina’s strategy to “be the Volvo/BMW” rather than the cheapest option was a rational response to this reality and, for more than a decade, it worked: models like the 445, 425, and 545 won major awards and sold into a loyal owner base.darglow+4

Where this strategy hurt was when volumes across the whole new‑sailboat sector shrank and the middle‑class buyer base eroded. A product mix skewed to higher‑ticket boats meant that downturns, interest‑rate spikes, and financing squeezes hit especially hard; fewer, more expensive units are much harder to sustain when credit tightens and discretionary spending falls. But that is a vulnerability, not the root cause.practical-sailor+1

Used-boat competition and fiberglass longevity

The explosion of capable used fiberglass boats was a powerful structural headwind. Catalina’s own success from the 1970s–1990s flooded the market with durable, still‑sailable hulls—C‑22s, 27s, 30s, 34s—that can be refit for a fraction of the cost of a new build. Industry analyses note that:bolsadenavegantes+1

- There is a large and growing inventory of older fiberglass sailboats whose hulls remain sound decades later.[practical-sailor]

- Buyers increasingly choose a $10–30k used Catalina or similar over a $250k+ new cruiser, especially when moorage, insurance, and refit are considered.[youtube][bolsadenavegantes]

This long‑term durability of fiberglass is a double‑edged sword: it underpins Catalina’s reputation and resale value, but it also depresses demand for new production. However, this pressure affected all builders; it helps explain a slow squeeze on margins and volumes, not the specific collapse in 2025–26.

Ownership, capital structure, and immediate cause

The proximate cause of the bankruptcy is much more traceable: the sale to Michael Reardon and the ensuing financial mismanagement. In 2025 Catalina and True North were acquired by Reardon (Daedalus Yachts) on very thin capital, with deferred payments and lease obligations on the Largo plant. Within months:bwsailing+1

- Production was “paused” due to “short‑term financial challenges.”marinebusiness+1

- Rent went unpaid on the Largo facility, leading to eviction proceedings.sailingscuttlebutt+1

- Employees reported missed paychecks and loss of health insurance before operations were shut down.pacificyachting+1

By early 2026, Catalina was effectively asset‑stripped: no factory, no production, unpaid creditors, and pending customer orders without the means to fulfill them. That chain of events is directly tied to the capital structure and management practices of the new owner, not to Gerry Douglas’s design choices or to a single marketing strategy.thestreet+1

In other words, structural headwinds (used‑boat glut, fiberglass longevity, demographic changes, foreign competition) put Catalina under sustained pressure, but the fatal blow was a highly leveraged, under‑capitalized acquisition that failed to meet basic obligations like plant rent and payroll.marineindustrynews+2

Family intent and the “MacGregor office park” idea

There is no credible evidence that Butler’s family intended to follow Roger MacGregor’s playbook and deliberately convert the Largo plant into an office park. MacGregor famously shut down his own production and redeveloped land, but Catalina’s trajectory looks different:proboat+2

- For years after Frank Butler’s death in 2020, the company continued to develop and build serious cruising boats (e.g., 545) and invest in the 5 Series.sailingmagazine+1

- The Largo plant was lost through eviction for non‑payment of rent under Reardon’s ownership, not via a planned family redevelopment scheme.bwsailing+1

If anything, Butler’s heirs seem to have opted for an exit via sale to a supposed “rescuer” consolidator rather than overseeing a managed shrink‑down or orderly wind‑up themselves. That choice—whom to sell to, on what terms, and with what safeguards—does sit with the family and prior management, and you can fairly say they bear part of the responsibility for entrusting the brand and workforce to a buyer who did not have the capital or discipline to sustain operations.facebook+1

So who is “ultimately” to blame?

If you have to apportion responsibility:

- Primary, immediate responsibility lies with the 2025 acquirer (Reardon/Daedalus) for under‑capitalized consolidation, unpaid obligations, and the loss of the Largo plant that made continued production impossible.bwsailing+2

- Secondary responsibility lies with prior ownership (the Butler family and senior management) for selling into that structure without stronger protections for the company’s solvency, employees, and customers.

- Background causes include industry‑wide forces: the massive, durable used‑fiberglass fleet (Catalina’s own legacy), demographic/participation shifts, and global competition from Beneteau/Jeanneau et al.—all of which squeezed margins but did not by themselves require bankruptcy.darglow+2

The decision to move upmarket with the 5 Series and powerboats certainly raised Catalina’s exposure to macro shocks, but it was a plausible strategic response to Beneteau’s dominance at the entry level, not the core “mistake.” The collapse happened when fragile financing met a historically tough market—and when a storied brand no longer had Frank Butler’s conservative, cash‑focused stewardship guarding the downside.boatingindustry+2

Citations:

The Street, “An iconic sailing company declares bankruptcy and shuts down after 46 years” (January 6, 2026)thestreet

Wikipedia, “Catalina Yachts”wikipedia

Wikipedia, “Frank Butler (founder)”48north

Cruising World, “Eight Bells: Frank Butler, Founder of Catalina Yachts” (May 2023)sailingscuttlebutt

Catalina Yachts Official Historywikipedia

48° North Magazine, “Jolly Roger MacGregor and the Pirates of the South Coast” (August 2025)practical-sailor

Catalina Yachts Chronological Historypacificyachting

Albemarle Observer, “Catalina Yachts Halts Production Amid Financial Challenges” (October 2025)cruisingworld

Wave Train, “Dead Guy: Frank Butler” (December 2020)reddit

Professional BoatBuilder, “Frank Butler Farewell” (February 2021)reddit

Catalina 380 Technical Specificationsproboat

American Sailing Association, “ASA Remembers Catalina Yachts Founder Frank Butler” (January 2025)ybw

SpinSheet, “Catalina 27 Used Boat Review” (March 2017)boatindustry

Bolsa de Navegantes, “Catalina 30: Sailboat Data, In-depth Review & Buying Tips” (August 2025)wavetrain

YouTube, “What does a sailboat cost? — My Catalina 22 for example” (May 2020)sailboatowners

YouTube, “Sailboat Prices Make NO Sense… Here’s What’s Really Going On” (December 2025)finance.yahoo

Sailing Scuttlebutt, “What’s Really Happening to Catalina & Tartan Yachts?” (October 2025)latitude38

Boat Industry News, “Catalina Yachts interrupts production, future in question” (October 2025)macgregorsailors

Sailing Scuttlebutt, “Catalina Yachts owner evicted from factory” (October 2025)bwsailing

Yahoo Finance / The Street, “Iconic boat company closes down after 56 years” (November 2025)facebook

Massey Yacht Sales, “This History of Catalina”darglow